Experience Rating Review & Modification

An Experience Rating (also known as an Experience Factor or EMR) is a calculation derived from an employer’s claim cost history over a three-year period.

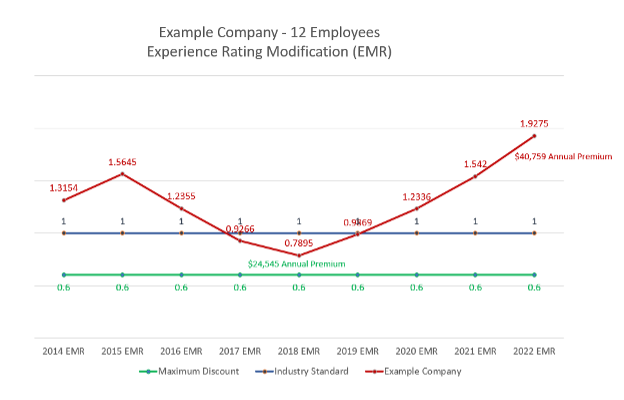

New companies are given a base factor of 1.0000. After about 18 months, a company will receive an updated experience rating based on their claim expenses during that period. If an employer has good claim performance, their rates will be reduced over time, and they will receive a discount (or pay less than the industry standard of a base rate of 1.0000) on their premiums. However, if an employer has poor claim performance and costly claims, the rate will increase, and the employer will pay a surcharge on their premiums.

Claim costs do not impact your Experience Rating until a year after the date of injury. Then, once those costs hit your books, your Experience Rating can only increase at a maximum rate of 25% per year, then can only drop back down at a maximum rate of 25% per year. Essentially, one expensive claim can adversely impact your EMR for a total of 6-7 years.